You'll still be able to raise donations through shopping, but we'll soon be launching two new complementary products designed to transform your fundraising efforts:

Direct Donations

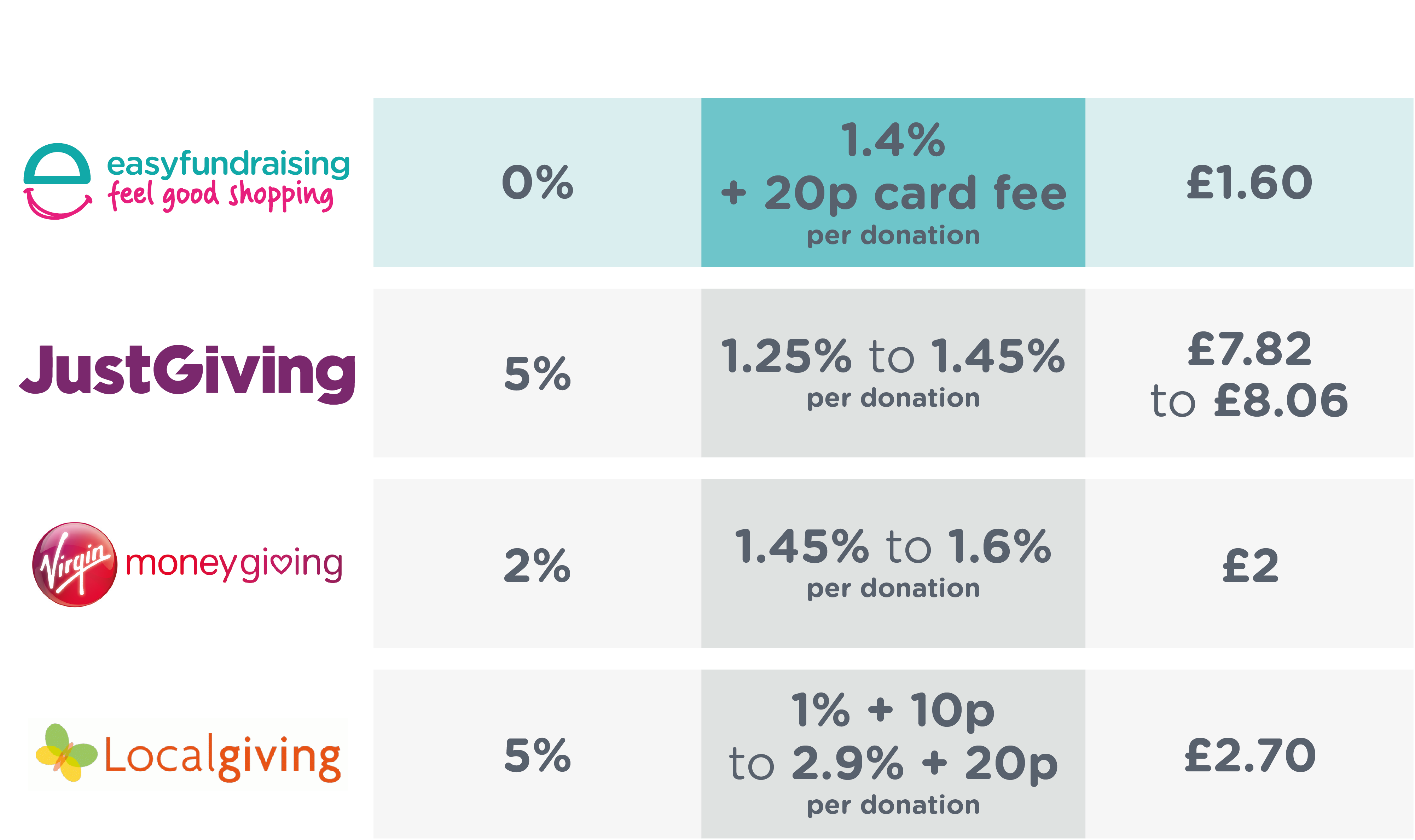

Collect donations direct from your supporters for a lower fee compared to other fundraising sites.

Fundraising Pages

Helping your supporters raise more through sponsored events and activities.

Why use easyfundraising?

✓ We’ve created a one-stop fundraising service where, for the first time ever, you’ll be able to manage your shopping and direct donations in one place.

✓ We’ll have lower fees than JustGiving, Virgin Money Giving and Local Giving to give more back to the community.

The sooner you sign up, the sooner your supporters can start raising even more donations.

We want to give more back to you. We're keeping our platform fee at 0% for registered charities and groups, this way when your supporters donate to your cause you know that you’re getting more donations for your cause to spend on the things you need the most.

We put you, our causes, at the heart of everything we do, and we will continue to give you the best prices to help you achieve your fundraising goals.

As a Registered Charity or Group:

✓ Charity Commission Number (if applicable)

✓ Unique Tax Reference (UTR)

✓ CASC Number (if applicable)

✓ Gift Aid status

✓ Bank details

✓ Trustee Information

What is a UTR Number?

Your UTR (Unique Taxpayers Reference) is the 10-digit number allocated to you by the HMRC (Her Majesty’s Revenue & Customs) for all matters related to your (personal) tax obligations. You can find it quoted on all correspondence received from HMRC.

If you need help to find your number, visit: https://www.gov.uk/find-lost-utr-number

What is a CASC Number?

As a CASC (Community Amateur Sports Club) you can claim Gift Aid, and will receive certain tax relief benefits and business rates relief. All CASCs must register with the HMRC, who will then allocate a unique CASC number.

If you need help to find your number, visit: https://www.gov.uk/government/publications/community-amateur-sports-clubs-casc-registered-with-hmrc--2

If you have not yet registered, you can find out more here: https://www.gov.uk/register-a-community-amateur-sports-club

What is a Registered Charity Number?

If you have applied to the Charity Commission to become a Registered Charity and they have accepted your application, you will have been allocated a unique Registered Charity Number.

You can find your charity number at: https://www.gov.uk/find-charity-information

If you have not yet registered, you can find out more here: https://www.gov.uk/guidance/how-to-register-your-charity-cc21b

What is a trustee?

Trustees have overall control of a charity. They are responsible for ensuring the charity is following best practice in order to achieve its stated aims.

You can find out more about becoming a trustee at: https://www.gov.uk/guidance/charity-trustee-whats-involved

Are there any hidden fees?

Our fees are totally transparent - so you don’t need to worry about any nasty surprises down the line.